Blog

Filter By

Location

16/04/24

Things To Do This Summer In Bristol 2024

Sun, Fun, and Festivals: Discover Bristol's Summer Showcase!

Read More12/04/24

Your Apartment Turns 7!

It's our 7th Birthday! Find out what we got up to this last year at Your Apartment...

Read More

10/04/24

Dannie & Carrie Salon x Your Apartment

Get your Glam on with Dannie & Carrie Salon and Your Apartment and get an exclusive discount!

Read More

03/04/24

Dog Friendly Serviced Apartments in London

Heading to London with your canine companion? No worries whatsoever! Learn more here...

Read More

28/03/24

Thames Rockets x Your Apartment

Time to hit the waves! Discover our exclusive partner discount with Thames Rockets...

Read More

27/03/24

Things To Do This Easter In Bristol 2024

Bristol in Bloom: Discover the best of Bristol this Easter.

Read More22/03/24

Go Big in The Big City

Looking for a large short term let or a large serviced apartment in London? We have some amazing choices available. Explore them here...

Read More15/03/24

The Broadcaster x Your Apartment

Tune into Shepherd's Bush's top restaurant and discover our exclusive partner discount...

Read More

13/03/24

The Old Market Quarters Best Nightlife

Bristol's After-Dark Anthem: A Guide to Old Market's Hottest Music Spots

Read More08/03/24

Discover Our London Partnerships

Discover Our London Partnerships and unlock exclusive discounts across the city...

Read More

07/03/24

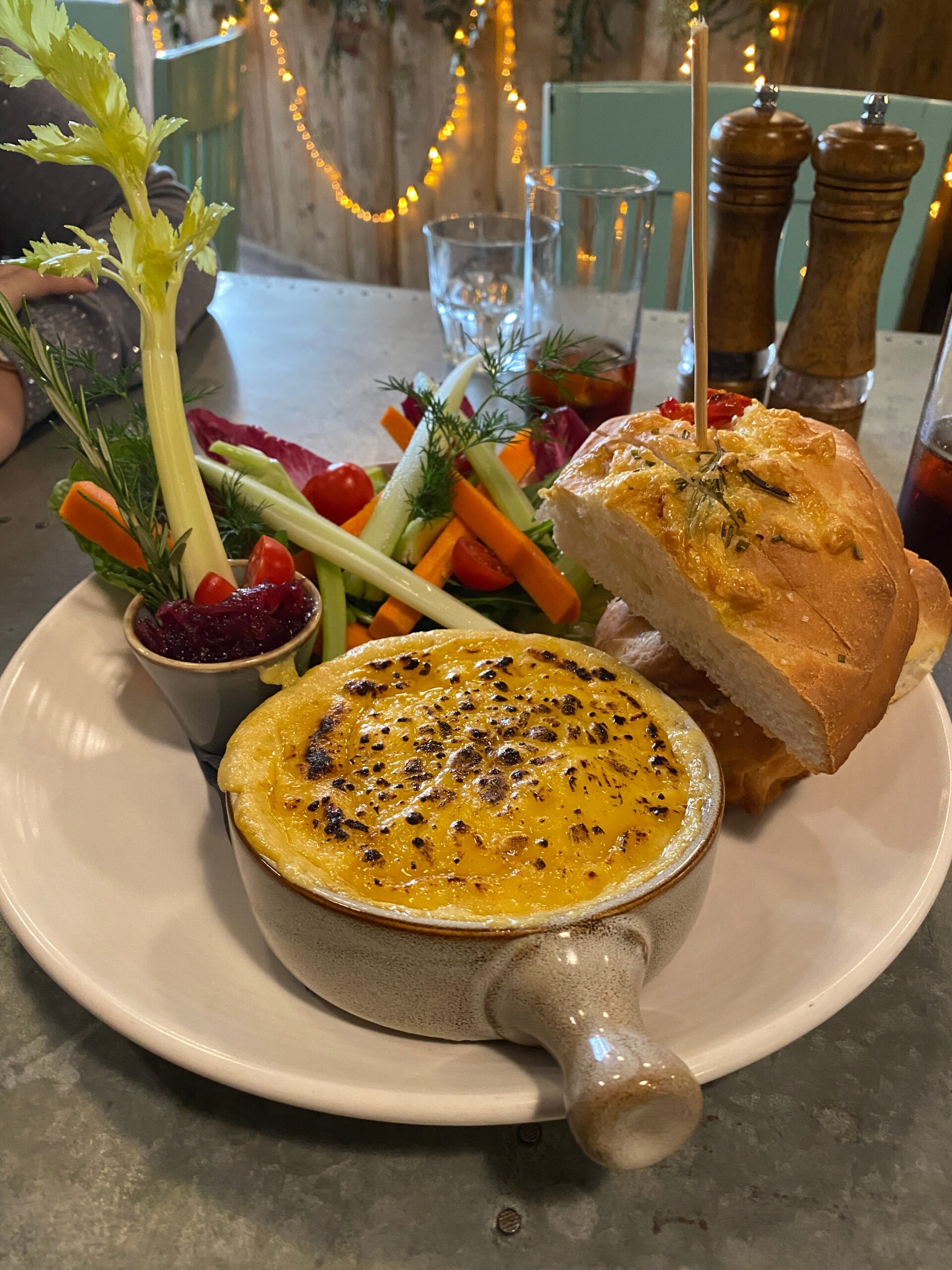

Best Restaurants Near Old Market Quarter

Dine like a Local: A Foodie's Guide to the Old Market Quarter in Bristol.

Read More01/03/24

Top Places to Drink in Milton Keynes

Embark on a delightful journey through the vibrant social scene of Milton Keynes as we unveil the city's best watering holes!

Read More29/02/24

St Patricks Day in Bristol 2024

Discover the best of Bristol's St. Patrick's Day 2024 celebrations!

Read More28/02/24

Business Travel

Elevate Your Business Travel Experience with Your Apartment: A Home Away from Home

Read More27/02/24

St Patricks Day in London 2024

Your Guide to St. Patrick's Day Fun in London 2024!

Read More26/02/24

Neighbourhood Guide: Cardiff City Centre

Whether you call Cardiff home or are an intrigued visitor, brace yourself for an immersion into the best food, drink and activities downtown Cardiff has to offer!

Read More25/02/24

Things To Do On Mother's Day 2024 in Bristol

Beyond Ordinary: Celebrate Motherhood Bristol Style

Read More19/02/24

Best Things To Do Near Cardiff City Centre

Explore the marvels of Cardiff City Centre: Your comprehensive handbook for a day of discovery.

Read More16/02/24

Neighbourhood Guide: Limehouse

Whether you're a local or a curious visitor to Limehouse, get ready to immerse yourself in the enchanting stories woven into the fabric of this amazing area.

Read More15/02/24

Choicest Things To Do Near Limehouse

Discover the wonders of Old Kent Road: Your ultimate guide to a day of exploration.

Read More14/02/24

Top Places To Drink Near Limehouse

Lime and Salt: A quick shot of the top bars and pubs near Limehouse

Read More13/02/24

Best Restaurants Near Limehouse

In The Limelight: Unmasking the Palate Pleasures of Limehouse...

Read More12/02/24

The Ultimate London Valentine's Day Guide 2024

London Love Letters: Crafting the Perfect Valentine's Day Experience!

Read More11/02/24

Best Places To Drink in Cardiff City Centre

Get ready to embark on a spirited journey through the best places to drink in Cardiff – from quirky cocktail hideouts to buzzing breweries and everything in between...

Read More10/02/24

Things To Do On Valentine's Day 2024 in Lambeth

A Local's Guide to Romantic Lambeth Escapes

Read More09/02/24

Our Top Eateries in Cardiff City Centre

Wales is famous for it hearty, rough around the edges, yet truly tasty nosh, this follows through into their no nonsense one of a kind independent restaurants...

Read More

07/02/24

Things To Do On Valentine's Day 2024 in Southwark

Love Notes in Southwark: A Valentine's Sonata

Read More29/01/24

Neighbourhood Guide: Canary Wharf

Get ready to delve into the unique allure of Canary Wharf and set out on an unforgettable expedition, traversing the lively streets of this remarkable district in the heart of London.

Read More28/01/24

Things To Do On Valentine's Day 2024 in Hammersmith & Fulham

Explore the best of Hammersmith & Fulham's Romantic getaways...

Read More25/01/24

Top Things To Do Near Canary Wharf

Banking on Fun: Exploring some of the best activities around Canary Wharf and East London.

Read More24/01/24

Things To Do On Valentine's Day 2024 in Wandsworth

Things To Do On Valentine's Day 2024 in Wandsworth

Read More22/01/24

Where To Drink Near Canary Wharf

Fork & Finance: Savouring Success at Canary Wharf's Finest Restaurants

Read More21/01/24

Things To Do On Valentine's Day In Bristol 2024

Beyond Roses: Creative and Memorable Valentine's Date Ideas in Bristol

Read More17/01/24

Best Places To Eat Near Canary Wharf

Fork & Finance: Savouring Success at Canary Wharf's Finest Restaurants

Read More14/01/24

Parking near Whiteladies Road

Most of the year there is ample parking for visitors to choose from near Whiteladies Road should they choose to stay with us. Find out where here...

Read More

12/01/24

London's Top Vegan Restaurants

Bean There, Done That: A Vegan's Guide to London's Culinary Kaleidoscope!

Read More10/01/24

Bristol’s Best Vegan Food

Discover Bristol’s Best Vegan Food, if you're visiting Bristol you simply must try these top notch vegan foodie spots dotted around the city!

Read More

09/01/24

Parking near Old Kent Road

Most of the year there is ample parking for visitors choosing to visit Old Kent Road should they choose to stay with us. Find out where here...

Read More

05/01/24

What Are Short Term Lets?

The Art of Temporary Living: Exploring the Wonders of Short Term Lets

Read More19/12/23

Your Apartment Opens New London Office

We're thrilled to announce the grand opening of our shiny new office in the heart of London, just a stone's throw away from the bustling Victoria Station!

Read More14/12/23

Best Bristol Christmas Events 2023

Dive headfirst into the heart of the festive spirit with our merry guide to Bristol’s winter wonderland!

Read More12/12/23

Serviced Houses - Bristol

Brace yourselves because we've just dropped our new collection of 'Serviced Houses' in the heart of Bristol!

Read More05/12/23

Londons Best Christmas Markets 2023

Unlock the enchantment of Christmas in London with our guide to the city's top festive markets!

Read More12/11/23

Discover Our Fully-Equipped Kitchens

Today, we're embarking on a gastronomic journey through our glorious apartments, unveiling the treasures that lie behind those pantry doors. Whether you're a kitchen novice or a seasoned pro, we've got the scoop on the crème de la crème of cooking spaces.

Read More09/11/23

Feels for November 2023

Here’s our pick of special events and experiences happening in and around Bristol this November in Bristol…

Read More01/11/23

Most Wanted Serviced Apartments in Bristol: Winter 2023-24

Each month we’ll be bringing you our top serviced apartments from within our Bristol collection. Here's our top picks for the Winter...

Read More

25/10/23

Best Italian Restaurants in Bristol

Pizza, Pasta, and Passion: Discover our guide to Bristol's best italian hotspots you don't want to miss out on!

Read More23/10/23

Parking near Temple Meads and Old Market

There is plentiful parking for visitors opting to explore the Temple Meads and Old Market Areas for the majority of the year. Discover the details right here...

Read More

22/10/23

Things To Do Near London South Bank University

Discover the wonders of Southwark: Your ultimate guide to a day of exploration.

Read More20/10/23

Parking in Tooting

Guests staying in Tooting will find an abundance of parking spaces near by. Find all the info on parking locations here...

Read More

19/10/23

New Restaurants in Bristol

Welcome to the vibrant and ever-evolving city of Bristol, where 2023 is ushering in a wave of exciting new foodie experiences and destinations!

Read More10/10/23

Parking near Saint Michael's Hill

Throughout most of the year, there is abundant parking available for visitors staying near Saint Michael's Hill, Bristol. Discover more here...

Read More

01/10/23

Dog Friendly Serviced Apartments in Tooting

Travelling to Tooting with your four legged friend? No problem at all! Learn more about what makes our accommodations perfect for both you and your dog.

Read More

12/09/23

Parking in Shepherd's Bush

Most of the year there is ample parking for visitors choosing to visit Shepherd's Bush should they choose to stay with us. Find out where here...

Read More

16/08/23

Canine Considered

Bristol Dog Fest 2023 is almost here and we are offering a special discount on our collection of dog friendly Bristol apartments...

Read More07/08/23

Old Kent Road: Not Just a Monopoly Square

Collect a good night sleep and some Candy Kittens for passing GO.

Read More25/07/23

Bristol Balloon Extravaganza!

Welcome to the dazzling world of Bristol's International Balloon Fiesta!

Read More10/07/23

Leading The Flock: Your Apartment - Shepherd's Bush

Shepherd's Bush: Your Stylish Haven in West London

Read More07/07/23

YA Roadmap to the best spots on Whiteladies Road

Discover Whiteladies Road: Bristol's Fashion, Food, and Fun Hub

Read More06/07/23

Your Apartment, Our Planet

Our Eco-Friendly Serviced Apartments and the steps we have taken towards a greener tomorrow...

Read More19/06/23

Top Things To Do Near Old Kent Road

Discover the wonders of Old Kent Road: Your ultimate guide to a day of exploration.

Read More16/06/23

Best Places To Drink Near Old Kent Road

Rev Up Your Taste Buds: Discover the Best Drinking Spots near Old Kent Road!

Read More16/06/23

Best Places To Eat Near Old Kent Road

Taste Sensations: Exploring Old Kent Road's Foodie Hotspots

Read More16/06/23

Top Things To Do In Southwark

Embark on an exciting journey through Southwark with our ultimate guide! Click here to discover more about this vibrant area.

Read More16/06/23

Best Places to Drink in Southwark

Sipping Splendours: Unleashing Southwark's Liquid Delights!

Read More15/06/23

Top Foodie Spots in Southwark

Savour the Flavour: A Food Lover's Guide to Southwark

Read More15/06/23

Neighbourhood Guide: Old Kent Road

Prepare yourself to discover the hidden mysteries of Old Kent Road and embark on an unforgettable expedition through the lively streets of this remarkable district in London.

Read More14/06/23

Neighbourhood Guide: Southwark

Get ready to uncover the secrets of Southwark and embark on a memorable journey through this captivating corner of London.

Read More25/05/23

Summer, Bristol Style!

Welcome to our Bristol summer bucket list, where we'll be your guide to the vibrant city of Bristol and all the fantastic experiences it has to offer this summer!

Read More21/05/23

Neighbourhood Guide: Shepherd's Bush

Are you ready for a wild ride through one of London's most vibrant and eclectic neighborhoods?

Read More20/05/23

Shepherd's Bush Bars & Pubs

Get ready to raise a glass to Shepherd's Bush's top watering holes.

Read More19/05/23

Top Things To Do In Shepherd's Bush

Looking for things to do out and about in Shepherd's Bush? Click here to find your next adventure!

Read More15/05/23

Best Places To Eat In Shepherd's Bush

Satisfy Your Cravings: A Guide to the Best Dining Destinations in Shepherd's Bush

Read More20/04/23

Nominated at Serviced Apartment Awards 2023

We've been put forward for 6 awards including "Best Operator" at this years Serviced Apartment Awards 2023

Read More

13/04/23

New Apartments Launch in West London this Spring

This Spring we are launching our second London location in the Borough of Hammersmith & Fulham.

Read More16/03/23

Candy Kittens x Your Apartment: Sweet Surprises

We're taking our guest experience to the next level by partnering with Candy Kittens to include their sweets as a welcoming gift.

Read More

14/03/23

Hypnos at Your Apartment

Your Apartment have upgraded our beds to the best of the best, Hypnos mattresses! And let us tell you, these beds are the stuff of dreams...

Read More08/03/23

Dog Friendly Serviced Apartments in Milton Keynes

Travelling to Milton Keynes with your furry friend? No problem at all! Learn more about what makes our accommodations perfect for both you and your dog.

Read More

06/03/23

Fun Things To Do in Tooting

This vibrant London neighborhood has something for everyone, from delicious food to exciting activities and events.

Read More05/03/23

Best Bars in Tooting

Uncover Tooting's vibrant bar scene with our curated guide to the top places to drink in the neighbourhood.

Read More04/03/23

Top Places To Eat In Tooting

Discover the top places to eat in Tooting with our guide to the best places to chow down in the neighbourhood. Read more on our blog now!

Read More01/03/23

Neighbourhood Guide: Tooting

Ready to spice up your London adventure? Tooting's got it all - food, fun, and funky vibes. Don't miss out, check out our Tooting guide now...

Read More11/08/22

Best Snack Shacks in Old Market

Old Market is packed full of great little grab & go bakeries, cafes & street food. Here's our complete local guide...

Read More

10/08/22

Local Venues in Milton Keynes

One of our favourite things to do in the area is see What's On at some of the local venues in Milton Keynes. Here's our guide...

Read More19/07/22

Decent Places to Eat in Milton Keynes

Every great city needs great places to eat and Milton Keynes is no exception. On our neighbourhood travels, here's our top places to eat...

Read More07/07/22

Bigger is Better

If you're looking for a large short term let or a large serviced apartment Bristol has some incredible options. Take a look here...

Read More

01/07/22

Serviced Apartments in Bristol with a View

Whether you're looking for a short term let in Bristol or a serviced apartment, you can't deny that to have one with a view is just the cherry on the cake...

Read More

23/06/22

We're Partnering with Plum Guide

Plum Guide is just next level. And the best part is, some of our serviced apartments in Bristol are to be featured on their site soon...

Read More

20/06/22

Things to Do in MK

Being a new city, Milton Keynes has been on the front foot when it comes to innovative, experiential and well, just fun thing to do...

Read More15/06/22

Cool Places to Drink in Old Market Quarter

Old Market is gradually redefining itself as one of Bristol's most up-and-coming suburbs. Here's our complete local guide to Old Market...

Read More

08/06/22

Neighbourhood Guide: Milton Keynes

One of the UK's newest cities, Milton Keynes is a hub for domestic & international business travel. Here's our neighbourhood guide to Milton Keynes...

Read More01/06/22

Coworking Spaces in Milton Keynes

Milton Keynes is the home of the HQ. But head offices aren’t always great places to work, coworking spaces however, are.

Read More

06/05/22

Nominated at Serviced Apartment Awards 2022

Your Apartment Director & Co-Founder, Toby Guest, is going to be speaking at this year's virtual 'The Innofac Show' 2022 this January...

Read More

08/04/22

What's On in Bristol this Easter Weekend?

Discover What's On in Bristol this Easter Bank Holiday Weekend. Book two night between 14th & 17th April & get 50% OFF a third night...

Read More30/03/22

Bars That Will Get You Tipsy in Brixton

When it comes to letting your hair down, Brixton is home to some of the coolest bars in London. Here's a few places to stop by...

Read More08/02/22

Six Wins in ‘Traveller Review Awards 2022’ by Booking.com

We’re very chuffed to be starting 2022 with not one, but six ‘Traveller Review Awards’ which encompass 20 of our serviced apartments in Bristol...

Read More

14/01/22

Where to Get Fed in Brixton

When it comes to eating well, Brixton does not disappoint. The restaurant are chill, affordable and London-class. Here's our rundown...

Read More13/01/22

Director & Co-Founder Toby Guest at The Innofac Show 2022

Your Apartment Director & Co-Founder, Toby Guest, is going to be speaking at this year's virtual 'The Innofac Show' 2022 this January...

Read More

14/12/21

Neighbourhood Guide: Brixton

Brixton is always undergoing a 'trendvolution' with new things opening every week. Here's our local guide to Brixton...

Read More13/12/21

Top 11 Airbnb’s in Bristol

Heading to the heart of the West Country for a few days or more? Here are eleven of our very best Airbnb apartments in Bristol…

Read More25/11/21

Introducing Your Apartment - Clifton House

Introducing our new collection of Clifton short lets, Your Apartment - Clifton House. Contactless & colourful studio & one bed serviced apartments in Clifton...

Read More04/11/21

New Partner: Foodstuff

We've teamed up with the independent zero-carbon delivery provider, Foodstuff. This means that our guests can now benefit from 25% off...

Read More

14/10/21

Five 15 Min Healthy Meals To Cook in Your Apartment

We have asked our small team to inspire you with recipes that can be prepared in 15-minutes at one of our serviced apartments in Bristol...

Read More

11/10/21

Meet Cosmin.

He joins us from City Relay to become a part of London's freshest serviced apartment provider (aka us). Get to know him...

Read More

08/10/21

Charlie’s 15 Min Low Carb, High Energy Super Salad

If you’re on a bit of a health buzz like Charlie is 24/7, then you’ll be all up for his Salmon Super Salad…

Read More

05/10/21

Borough by Borough: A Tourists Guide to West London

Planning a trip to stay with us at one of our serviced apartments in West London? If so, then you MUST read this guide…

Read More

01/10/21

Dan’s Low Fat 15 Min Super Berry Lemon Posset

Perhaps not the healthiest, but we’ll let it slide as this LP is low fat & one batch will make enough puds to last a week…

Read More

28/09/21

Neighbourhood Guide: Old Market Quarter

Old Market is gradually redefining itself as one of Bristol's most up-and-coming suburbs. Here's our complete local guide to Old Market...

Read More

23/09/21

Your Apartment is Now on YouTube

We're finally on YouTube & to kick things off we're showcasing out first ever promo video for Your Apartment - Clifton Village...

Read More

23/09/21

Antonio’s 15 Min Spaghetti Aglio Olio E Peperoncino

There's better than a great bowl of pasta. Even more so when it's an actual Italian recipe from our Reservations Agents, Antonio...

Read More

21/09/21

9 Reasons Why People Are Desperate For A ‘Fix’ Of Brixton

A big announcement is on its way. We've decided to familiarise ourselves with the area of Brixton and tell you about the best things to do...

Read More

16/09/21

Philip’s Healthy(ish) 15 Min Grilled Halloumi Sandwich

A go-to veggie lunchtime favourite to keep those meat cravings at bay…

Read More

15/09/21

Pocket Guide: How to be a Londoner

A guide to fitting into one of the world’s biggest cities, London in preparation for our biggest serviced apartment exploration to date...

Read More

10/09/21

Cosmin’s Healthy 15 Min Porridge with Berries & Banana

One to get the day started good and proper…

Read More

07/09/21

New Partnership with Viator

We've teamed up with popular experience provider, Viator, to provide our guests with a variety of things to do in Bristol which are off the beaten track...

Read More

03/09/21

Neighbourhood Guide: Ealing Broadway & West London

Here’s our definitive neighbourhood guide to living the local life in Ealing & West London...

Read More

03/09/21

Guide to Dog Friendly Places in Ealing

Calling all dog lovers and owners. Our dog-friendly serviced apartments in Ealing Broadway are your new place to call home and here's why...

Read More

26/08/21

Your Apartment - Clifton House Launching this November...

'Your Apartment - Clifton House' formerly Clifton House Hotel will be joining our family of serviced apartments this November...

Read More

26/08/21

10 Things You MUST Do in West London

We've managed to narrow down all there is to do in West London leaving just TEN essential activities. Read on...

Read More20/08/21

The Best of Places to Eat in Ealing Broadway

Here’s the rundown of our top picks for dining in and around Ealing Broadway…

Read More06/08/21

Director & Co-Founder Toby Guest at Independent Hotel Show 2021

Your Apartment Director & Co-Founder, Toby Guest, is going to be speaking at Independent Hotel Show 2021. Find out more...

Read More

28/07/21

Dog Friendly Serviced Apartments in Bristol

What's the best solution for travelling to Bristol if you have a dog? Bringing it with you! Find out more about what makes our serviced apartments dog-friendly...

Read More

26/07/21

Your Apartment - Shepherd's Hall Launching in Bristol

Welcoming Your Apartment - Shepherds Hall, our second new aparthotel to the family.

Read More20/07/21

Five Considerations When Choosing A New Workplace

Need some advice finding your next workplace? If so, read about the things we considered when creating a new coworking space in Bristol at Your Apartment...

Read More25/06/21

Your Apartment - Clifton Village Featured on Bristol Live

One of Bristol's leading business journalists recently checked in to Your Apartment - Clifton Village. Find out how they got on...

Read More15/06/21

Review: Your Apartment - Clifton Village by Geeta Dhar

One of London's many voices of the travel & foodie scene, Geeta Dhar came to stay with us at Your Apartment - Clifton Village. Take a read...

Read More10/05/21

Review: Your Apartment - Cotham by Jo Middleton

We had the pleasure of hosting prolific South West travel & lifestyle blogger, Slummy Single Mummy (aka. Jo Middleton) at Rowan Tree. Take a read...

Read More27/04/21

Back to the... Coworking Space

By Daniel Robinson - Your Apartment's Marketing Manager

Read More

23/04/21

Review: Your Apartment - Clifton Village by Emily Henley

We had the pleasure of a visit from one of Bristol's most trusted critics Emily Henley at Your Apartment - Clifton Village. Take a read...

Read More

23/04/21

Independent Shopping in Cotham

Cotham's vibrant neighbourhood has a bijou collection of local and independent shops. Here's our guide to independent shopping in Cotham...

Read More

22/04/21

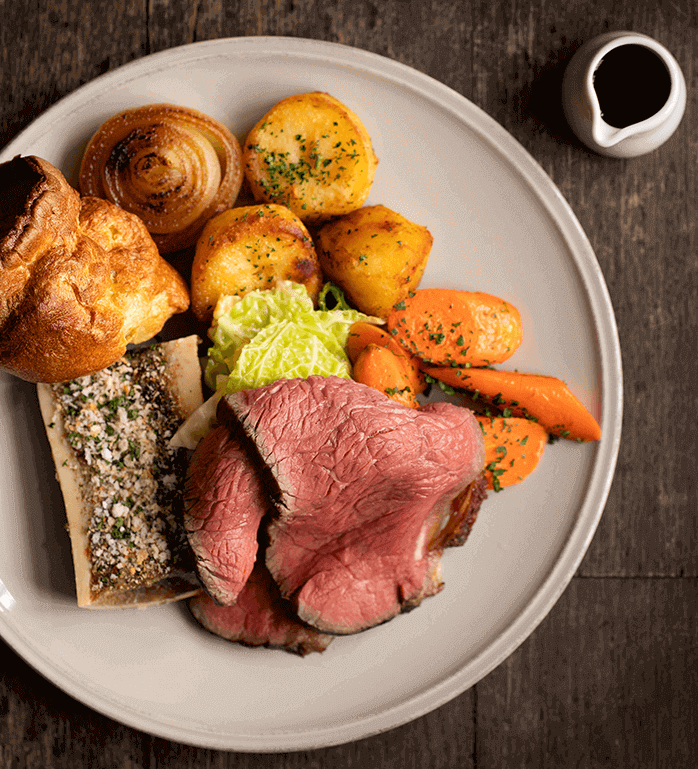

Top Public Houses & Sunday Lunches in Cotham

Love a good roast and a traditional pub? Cotham has a good range of public houses and Sunday lunches to wrap up the week...

Read More

22/04/21

Places to Perch for a Drink or Two

Cotham isn't just a serious contender on the food scene, but it also has some very tidy bars and quenching spots too. Here's the rundown....

Read More

19/04/21

Decent Places to Eat in Cotham

Cotham is a serious contender on the Bristol food scene. Here's our guide to some of the top places to add to your agenda in 2021...

Read More

12/04/21

Are Aparthotels and Serviced Apartments Self-contained Accommodation?

Confused by the latest Government Guidance? You're not alone. Here's some direction...

Read More

09/04/21

Your Cotham Bucket List

Here are the top things to see & do during your stay at one of our serviced apartments in Cotham, Bristol in 2021. Read the guide...

Read More

31/03/21

Neighbourhood Guide: Clifton

Whether you're staying elsewhere in the city or calling Clifton Village home at one of our serviced apartments, get to know Bristol's most iconic neighbourhood...

Read More

26/03/21

Shopping for the Pantry in Clifton

Shopping for food has kept most people going over the past year or so and Clifton has got oh so independent...

Read More

26/03/21

Meet Katy.

She's is everything you want in a housekeeper, manager & human being. Get to know her as we do...

Read More

16/03/21

Top 'On The Go' Places in Clifton

Just because you're on the move doesn't mean that you shouldn't be well fed and watered. And Clifton certainly accommodates...

Read More

15/03/21

Top Drinking Spots in Clifton

We've been known to frequent many a pub, cocktail bar and prohibition bar in our time and this is mainly because Clifton us full of them...

Read More15/03/21

Top Places to Eat & Drink in Clifton

From gastropubs to cocktail tapas joints, Clifton's a grazing & guzzling ground. Here are our top spots to combine eating and drinking in Clifton...

Read More15/03/21

Meet Andy.

He's all hands on deck, if it's broken then he usually knows exactly how to fix it. Get to know him as we do...

Read More

12/03/21

Your Apartment on Fin & James TV

We had Fin & James stay with us at our new aparthotel in Clifton Village. Here's how they got on trying Bristol's 'worst rated' restaurant...

Read More

10/03/21

12 Reasons to Visit Bristol in 2021

Pack your bags and pick Bristol (the greatest city in the UK) for a staycay. Oh wait, and here’s why…

Read More05/03/21

Sunday Lunch Spots in Clifton

If you love a good roast then you'll be spoilt for choice in Clifton. Here are the top places which serve Sunday lunch in Clifton...

Read More

03/03/21

Tidy Grazing Spots in Clifton

If you're a lover of a good unpretentious feeding, then these cool places to eat in Clifton should be a good head start...

Read More26/02/21

Parking in Clifton Villlage

Most of the year there is ample parking for visitors choosing to visit Clifton Village should they choose to stay with us. Find out where here...

Read More

24/02/21

Meet Charlie.

Meet Charlie Guest. He's one of our leaders, Co-founder and our Managing Director. Get to know him like we do...

Read More

23/02/21

Cool Places to Eat in Clifton

If you're a lover of a good unpretentious feeding, then these cool places to eat in Clifton should be a good head start...

Read More19/02/21

Your Clifton Landmark Bucket List

Bristol has so much more to offer than just a bunch of landmarks. Here's our non-biased guide to exploring the vibrant neighbourhood of Clifton.

Read More

17/02/21

We're now on Homes & Villas by Marriott

Are you a frequent Marriott customer? We've been carefully selected to appear on Homes & Villas alongside the rest of their portfolio.

Read More

12/02/21

Meet Rohit (aka. Philip).

Meet Philip, our brightest and most charming Guest Relations Executive. Find out why we think he is great...

Read More

05/02/21

Surprisingly Less Popular Filming Locations in Bristol

We've rooted out some known but not overused filming spots in the city...

Read More

29/01/21

Meet Toby.

Meet Toby Guest, Co-Founder & leader of our Ops Division is Toby. Find out why he's a man of so many skills...

Read More

29/01/21

Ready to Relocate to Bristol?

Are you really ready to relocate to Bristol? Read our guide to discover how finding the right short term let in Bristol can help you...

Read More

25/01/21

Top Coworking Spaces in Bristol

Need a desk for the day in Bristol? We've got you covered with these 6 coworking spaces throughout the City.

Read More

22/01/21

Meet Antonio.

Heading up our Reservations Team is Antonio. Find out why we love him and you might find you love him too...

Read More

20/01/21

NEW! Coworking Space

Introducing our brand new Co-working Space at Your Apartment Clifton Village in Bristol...

Read More08/01/21

Introducing Your Apartment - Clifton Village

Introducing our new aparthotel in Clifton Village. A collection of entirely contactless, fresh and vibrant studio serviced apartments in Bristol...

Read More10/12/20

Sion Hill Review: Lou Archell at Little Green Shed

It's not every day we have the pleasure of hosting the lovely Lou Archell from Little Green Shed at Your Apartment.

Read More

24/11/20

A Safe Place to Stay & Work

Here is an overview of how we intend to ensure that we can offer you a safe place to call home in 2021...

Read More

13/11/20

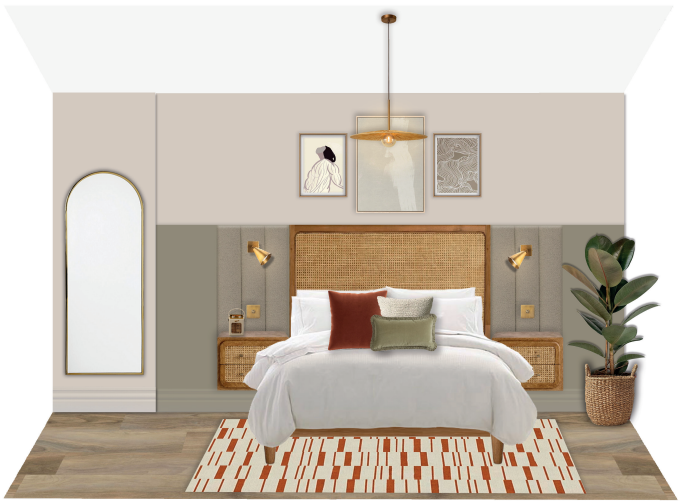

Your Apartment - Clifton Village: Q&A with Homewings

As the interim contractors finish up with the snagging, it's over to Homewings who have been busy working on injecting the vibrant and fresh look and feel of Your Apartment into the interiors...

Read More

03/11/20

New Partnership with Good Sixty

Your Apartment teams up with food delivery service, Good Sixty to support local food and drink independent businesses...

Read More

14/10/20

Your Apartment - Clifton Village Launching in Bristol

Welcoming Your Apartment - Clifton Village our new flagship aparthotel to the family.

Read More

28/09/20

The New Homeworking Hype

Find new ways to satisfy your need to connect with a change of scenery and city. Oh and don't be wasting any of that annual leave…

Read More

22/09/20

The 8 ‘Bestaurants’ or Best Restaurants in Liverpool City Centre

We love to eat out at local independent foodie gaffs all over Liverpool and we thought we'd let you in on some of our favourites at the moment....

Read More

04/09/20

Top 9 Things To Soak Up in the Heart of Liverpool

We’ve put together a list of the top 9 things to soak up in this gorgeous city...

Read More

04/09/20

12 Restaurants to Keep Visiting this September in Bristol

Get ready to tantalise your taste buds and explore the diverse and delectable world of Bristol's dining scene. Join us as we take you on a delicious adventure, one plate at a time.

Read More

02/09/20

Fun Facts You Should Read About Cardiff Before Visiting

If you're planning on booking yourself a trip to Cardiff, then have a read of this...

Read More

27/08/20

LOVE Cardiff: Ten Reasons To Visit

Cardiff is just such an awesome place. There's so much to see and do and the people are just so friendly and fun... Honestly, it's just a great place - enough said!

Read More

18/07/20

Blogger diaries: Bristol’s best gluten & dairy free meals

Breaking news - Bristol has recently been named as the vegan capital of the UK!

Read More

16/07/20

Things to do: Museums & Art galleries

Are you a lover of museums and art galleries?

Read More

10/07/20

Wapping Wharf: The ultimate foodies guide

Your Apartment has put together the best places to eat in Wapping Wharf.

Read More

20/06/20

Things to do in Bristol: The Bucket List

The things you must do when visiting Bristol.

Read More

18/06/20

Things to do: Where to see Bristol's famous Street Art

Discover hidden Banksy art, wall murals and modern murals.

Read More18/06/20

Food: The best brunch spots in Bristol

Looking for the best brunch spots in Bristol?

Read More

18/06/20

Getting around Bristol: An insiders guide

How to get around Bristol without a car.

Read More

08/06/20

Your neighbourhood guide: Arnos Vale / Brislington

Check out our neighbourhood guide with all our recommendations.

Read More

05/06/20

Neighbourhood Guide: Bristol City Centre, Harbourside & Old City

The City Centre is the perfect location for those looking for something a little more lively.

Read More

04/06/20

Your neighbourhood guide: Bristol Harbourside

Check out our neighbourhood guide with all our recommendations.

Read More

01/06/20

The Best Vegetarian & Vegan Eateries in Bristol

Who says meat-free food also has to be flavour-free? Check-out these awesome vegan eateries in Bristol.

Read More

29/05/20

Your neighbourhood guide: Old Market & Temple Meads

Why not head just outside the city centre to Old Market and Redcliffe...

Read More

16/05/20

Family and Staff Accommodation - Bristol University

Short term lets, ideal for parents and lecturers visiting Bristol university.

Read More